By

![Elev8[2]](https://communityplaymaker.com/wp-content/uploads/2023/09/Elev82-scaled-e1694541914287.jpg)

Image courtesy of Joey Johnston

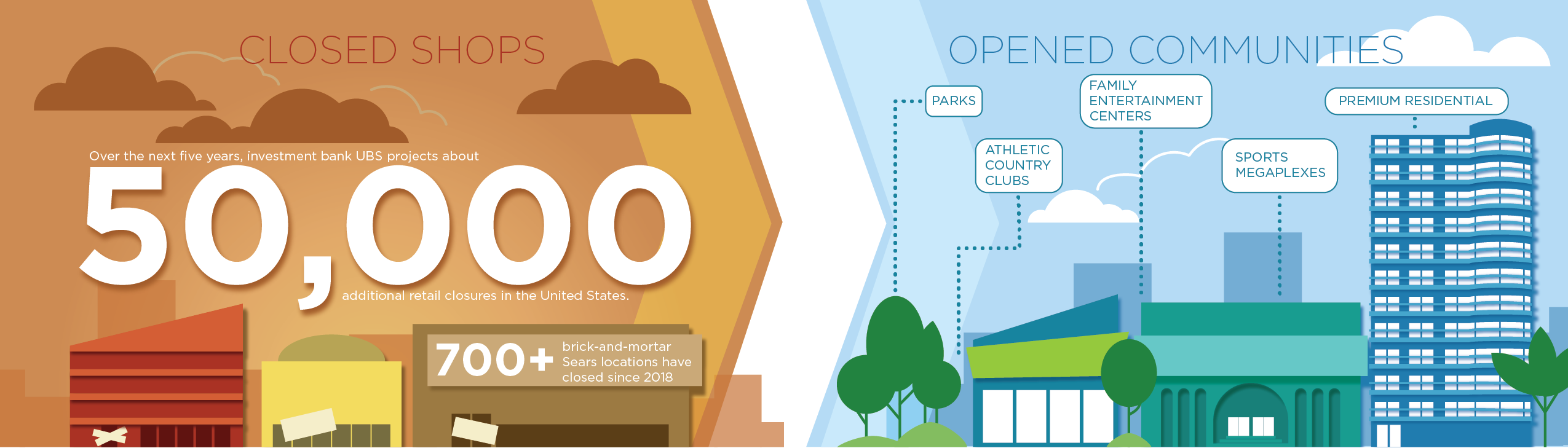

For nearly two decades, the 128,000-square-foot Sears store was a cornerstone of the Citrus Park Town Center, which opened in 1999 as a suburban shopping hub near Tampa, Florida. But, now it’s gone. A reflection of the nation’s ever-evolving purchasing habits. The iconic retailer has painfully disappeared; more than 700 brick-and-mortar Sears locations have closed since 2018, bringing a feeling of decay to malls across America.

Over the next five years, investment bank UBS projects about 50,000 additional retail closures in the United States. But in Tampa— and hundreds of other locations— the abandoned storefronts have returned to life after being “repurposed” for other uses, such as sports facilities or entertainment centers.

Where there was once a Sears, now there’s Elev8 Fun, a sports and entertainment center already gaining traction with local families. The old Sears store was purchased for $5.5 million by Prime Time Amusements, a South Florida firm, and the colorful, vibrant fun center formally opened in late May, welcoming the summertime crowd. Two other locations will open in Florida— coincidentally, in former Sears stores.

“We don’t pay rent, we buy the boxes (store locations),” said Keith Baldwin, Elev8 Fun’s director of operations. “It works well. It’s a lot more efficient than buying some land and putting up a building from the ground up. We get into an established location and we believe we give people another reason to visit the mall.”

Baldwin noted that shopping malls were declining prior to the COVID-19 pandemic. “Online shopping has changed malls forever. As the rents went up and the foot traffic declined, you saw closures all over the country. But that has also created new opportunities.”

These opportunities include:

Image courtesy of Dylan Lowdermilk

The mall closure trend has not only drawn the attention of business leaders and real estate professionals but city leaders as well. Vacated malls can become havens for crime. Repurposed malls provide cities with centrally located property for land development, along with popular assets such as pickleball courts. And if pickleball facilities exist in the private sector, it takes the pressure off a city’s parks department, which faces increasing demands to fund those assets.

When the Moorestown Mall in New Jersey underwent a 2022 facelift— an abandoned Sears became a three-floor outpatient facility of the Cooper University Health Care system, while a family entertainment center moved into an old Lord & Taylor. Mayor Nicole Gillespie was enthused.

“Obviously, the mall was a concern for a long time,’’ Gillespie told the Philadelphia Inquirer. “We have a lot of hope it will turn into something that feels very different. It’s a really fabulous version of what’s to come here.’’

The concern of cities over vacated big-box stores is very real. There’s the potential loss of property taxes. And, vacated stores are never a good look.

“We don’t like to see buildings sitting empty,’’ said Greenwood, Indiana Mayor Mark Myers in an interview with the Daily Journal of Franklin, Indiana. “They become an eyesore. They generally aren’t taking care of the exterior. Big-box stores are designed for a certain use, and a lot of the time, it is hard to reconfigure them.’’

In recent years, Myers has helped to find new tenants for vacated storefronts in his suburban Indianapolis community.

“I think there’s a real widespread problem for many cities, for the older malls closing up and these big-box stores that are just going vacant,” said Sara Baker, a Tucson, Arizona-based real-estate appraiser whose firm outlined the trend in a 2019 report for the Pima County Real Estate Research Council.

The report, prepared by Tucson’s Baker, Peterson, Baker & Associates, Inc., said there are increasing numbers of “owners seeking out service users to ‘Amazon-proof’ their retail centers” and “occupancy by these nontraditional users in retail centers is the biggest factor in driving down the retail vacancy rate.”

“It’s encouraging for the mall owners to have answers to questions such as, ‘What are we going to do with all of these empty buildings,” Baker said. “If you can find the right building in the right location, it seems like a win-win situation. Especially with construction costs so high, it’s so much more financially viable to renovate an existing facility. They’re looking for the right fit and the right space.”

For pickleball, which has been taking over parks and competing for tennis court space, the hollowed-out store spaces have been particularly appealing. According to the Sports and Fitness Industry Association, more than 9 million Americans are playing pickleball, a year-over-year increase of 85.7 percent. When it’s raining or snowing, when the heat is brutal, and when the park spaces are full, where can pickleball players go?

How about a former Burlington Coat Factory store?

That’s the scenario in southern New Jersey, where Proshot Pickleball opened with eight cushioned courts, viewing decks, a pro shop, and a players’ lounge. Andrew Pessano and his partners originally considered building it from scratch, but changed course after studying construction costs and the time necessary to acquire the land and permits.

The old Burlington site had everything— high ceilings (for lobs), lighting, restrooms, parking, and accessibility to the main roads. Pessano isn’t the only entrepreneur who has made this discovery. Around the country, indoor pickleball is moving into sites where Bed Bath & Beyond, Old Navy, and Saks Off 5th used to dwell.

“You can’t deny the popularity of pickleball and it’s going to continue to grow because anyone can play this sport,” Pessano said. “In these outdoor court situations, there’s always a situation with (lack of) parking and noise complaints, so taking it to an indoor facility makes so much sense.’’

Proshot Pickleball took 22,000 square feet, while the other 63,000 is occupied by a Restaurant Depot.

“I’m not a builder and none of my partners are builders, but we did help to build this place,” Pessano said. “We did some of the sub-work to get it open. We didn’t just write a big check. It was a dream of ours, and we built it well, within a budget, and now, it’s working. If we had chosen the other route, just starting from scratch and trying to build a new place, I don’t know where we’d be. I’m grateful this space was available to us.’’

While cities throughout the United States are losing their old mainstays for commerce and connection, they’re gaining a generation of innovative hubs that serve their communities by providing economic drivers, including restaurants and shops, and quality-of-life amenities like parks and walking trails. They’re elevating property values with their presence, and they are adding assets that can supplement those owned by city parks departments. In a word, they are adding opportunity. Less ‘run down’ and more ‘revitalized,’ there is new life for malls just waiting to be imagined.

Magazine

Playmaker Events

Connect with playmaker